What Is the Vig in Sports Betting?

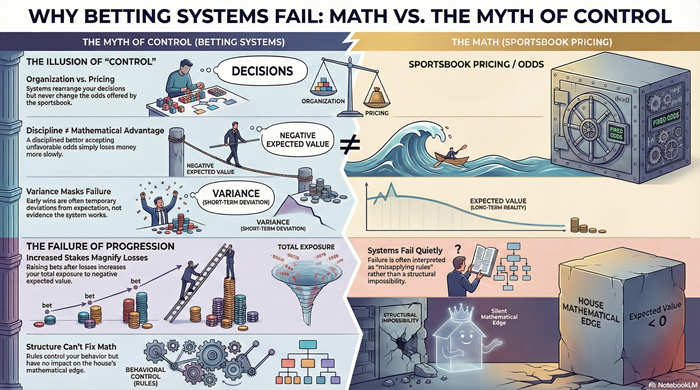

Most bettors understand that sportsbooks make money, but many struggle to explain exactly how. Losses are often attributed to bad luck, poor timing, or incorrect picks rather than structure.

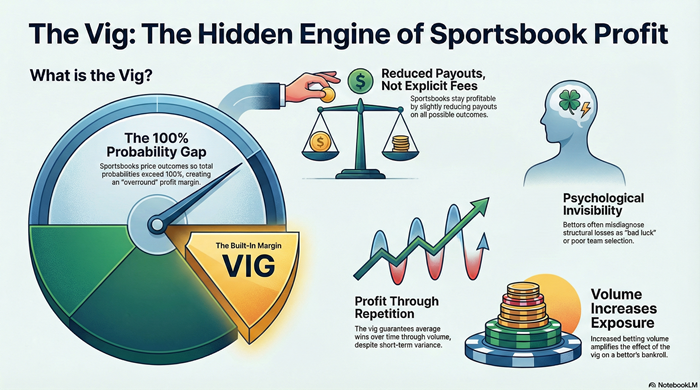

The core mechanism that ensures sportsbook profitability is the vig.

The vig, short for vigorish, is not a fee charged only when a bet loses. It is embedded directly into the odds and applies regardless of outcome. Understanding this is essential to understanding how sports betting actually works.

This article is part of a broader educational guide explaining how sports betting works at a structural level, including odds pricing, expected value, variance, and why certain bets are inherently risky. For the full overview, see How Sports Betting Really Works: Odds, Expected Value, and Why Parlays Are So Dangerous.

The Vig Is Built Into the Price

In a fair betting market, probabilities across all possible outcomes would add up to exactly 100 percent. In real sports betting markets, they exceed it.

That excess represents the vig.

Instead of charging bettors an explicit commission, sportsbooks slightly reduce payouts on all outcomes. Each bet looks normal in isolation, but collectively they ensure that bettors are paying more than fair value.

This design makes the vig easy to miss. Bettors see odds, not fees.

Why Both Sides Can Be Losing Bets

In many markets, bettors are presented with two opposing sides that both appear reasonable. One side may feel safe. The other may feel like value.

Structurally, both can be unfavorable at the same time.

Because the vig is applied to every outcome, no selection escapes it. The sportsbook does not need to predict which side will win. It only needs bettors to accept prices that include a margin.

This explains why sportsbooks remain profitable even when favorites win or when public money appears “right.”

The Vig Works Over Repetition

The vig does not guarantee that the sportsbook wins every bet. It guarantees that the sportsbook wins on average over time.

Individual outcomes are governed by variance. Pricing is governed by expectation.

This is why sportsbooks can tolerate short-term losses and still operate confidently. They are not dependent on individual games. They are dependent on volume.

Each bet contributes a small expected loss for the bettor. Over repetition, that loss becomes visible.

Why the Vig Is Hard to Feel

The vig operates quietly. It does not announce itself when a bet loses, and it does not visibly deduct money when a bet wins.

Because of this, bettors often misdiagnose losses. They attribute them to poor selection rather than unfavorable pricing. Winning streaks reinforce confidence even when expectation remains negative.

The structure stays hidden because outcomes dominate attention.

Why Reducing the Vig Doesn’t Eliminate the Problem

Some bettors believe that finding lower margins or shopping for better prices removes the house edge. While smaller margins reduce losses, they do not reverse expectation.

As long as a margin exists, the structure favors the sportsbook. Reduced vig slows erosion. It does not eliminate it.

This is why betting more does not improve results. Increased volume increases exposure to the vig.

Why Understanding the Vig Changes Perspective

Once the vig is understood, sports betting looks different.

- Losses stop feeling mysterious

- Wins stop feeling validating

- Confidence becomes less relevant than pricing

- Short-term results lose authority

Understanding the vig does not make betting profitable. It makes it intelligible.

It explains why sportsbooks do not need bettors to be wrong — only persistent.